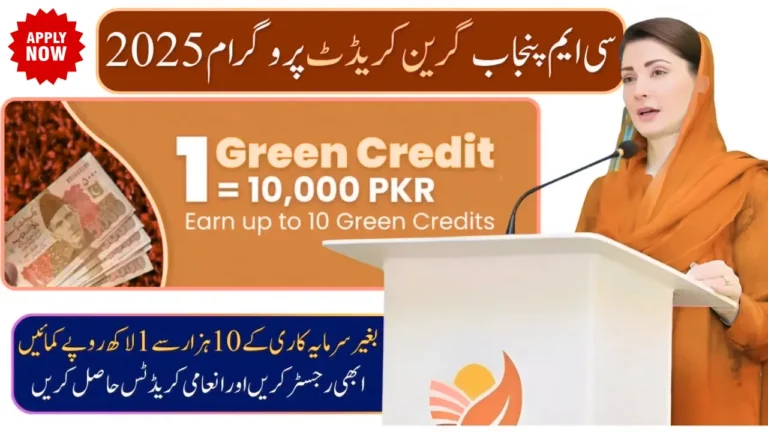

CM Punjab Asaan Karobar Finance 2025 Easy Business Loans for Youth

CM Punjab Asaan Karobar Finance 2025 Latest Update

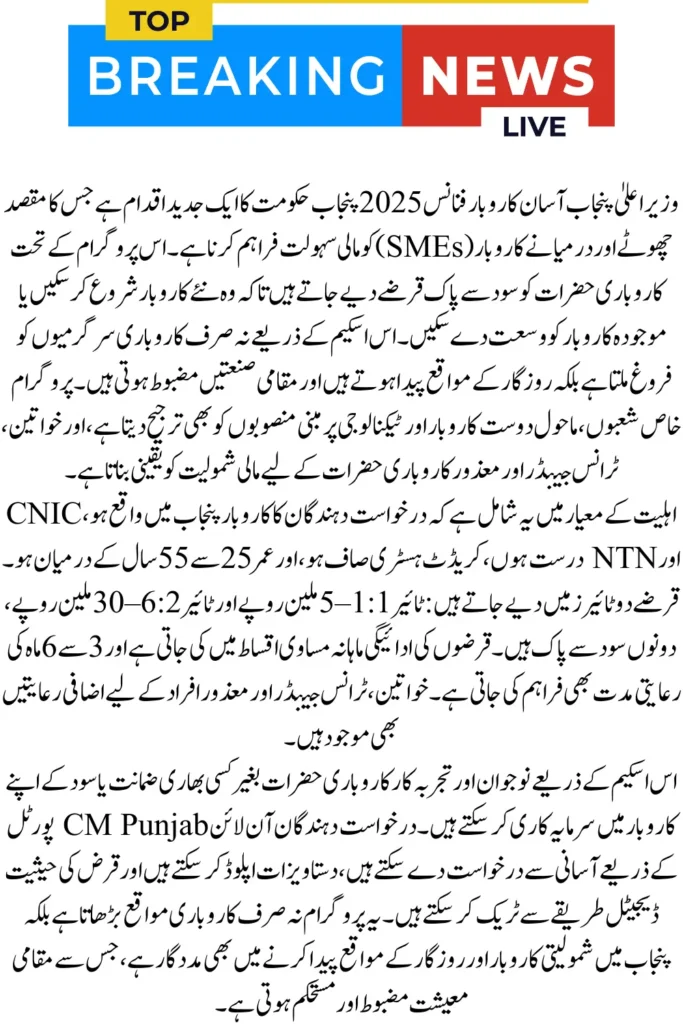

The CM Punjab Asaan Karobar Finance 2025 is a government initiative designed to help small and medium enterprises (SMEs) grow in Punjab. The program provides interest-free loans, making it easier for entrepreneurs to start new businesses or expand existing ones. This initiative is a step to boost economic activity, create jobs, and support local industries.

By focusing on priority sectors, the scheme also encourages innovation, climate-friendly businesses, and technology-driven ventures. Entrepreneurs from across Punjab can access funding under transparent conditions, with easy repayment options and minimal processing fees. The program also prioritizes women, transgender, and differently-abled business owners for financial inclusion.

You Can Also Read: BISP Re-verification 8171 September 2025 In 5 Minutes Complete Guide

What is the Asaan Karobar Finance Program?

The Asaan Karobar Finance Program aims to provide affordable and easy loans to small and medium businesses across Punjab. It offers funding for startup capital, working capital, leasing, and expansion, ensuring entrepreneurs have financial support to grow their operations without paying interest. The program emphasizes inclusivity and fair access for all eligible applicants.

This scheme also helps Punjab’s economic growth by supporting business owners with structured repayment plans, optional grace periods, and digital monitoring of loan usage. Entrepreneurs can leverage this support to invest in machinery, commercial vehicles, or green technologies. Overall, it is a platform to empower local business communities and boost economic resilience in the province.

You Can Also Read: Benazir Kafaalat September 2025 Payment Verification Process and Withdrawal Details

Eligibility Criteria – Who Can Apply for CM Punjab Asaan Karobar Loans?

Only eligible small and medium enterprises in Punjab can apply. Applicants must have clean credit histories, valid CNIC and NTN, and business premises within Punjab. The scheme ensures that funding reaches entrepreneurs who can utilize it effectively.

Requirements:

- SME with annual sales up to PKR 800M

- Age 25–55 years

- Active FBR tax filer

- Clean credit record

- Valid CNIC & NTN

- Business located in Punjab

- Ownership or rental of business premises

You Can Also Read: BISP 8171 September 2025 Easy CNIC Payment Verification and Rs. 13,500 Eligibility Guide

Step-by-Step Guide to Apply Online for Business Loans

The online application is simple and convenient. Applicants fill in their business details, upload documents, and select loan tier. Approval and disbursement follow transparent procedures with digital tracking.

Steps:

- Visit official CM Punjab portal

- Fill in business & personal details

- Upload CNIC & NTN documents

- Select loan amount & tier

- Submit application online

- Receive digital confirmation

- Track status via portal

You Can Also Read: CM Punjab Wheat Support Program 2025 Eligibility, Registration and Farmer Benefits Explained

Required Documents for Registration

Applicants need basic documentation to verify identity, business ownership, and financial status. This ensures transparency and proper use of funds.

Documents:

- Valid CNIC & NTN

- Proof of business ownership or rental

- FBR tax registration

- Financial statements for existing businesses

- Lease documents for commercial vehicles

- Passport-size photograph

- Any climate-friendly business certifications

You Can Also Read: Punjab Solar Tubewell Scheme 2025 Latest Update and Online Registration Guide

Loan Amounts, Repayment Plans, and Easy Installments

The program offers Tier 1 loans from 1–5M PKR and Tier 2 loans from 6–30M PKR with a grace period of 3–6 months. Repayment is through equal monthly installments, with optional discounts for women, transgender, and differently-abled applicants.

Details:

- T1: 1M–5M PKR, personal guarantee

- T2: 6M–30M PKR, secured loans

- Grace period: 3–6 months

- 0% interest for all tiers

- Handling & processing fees apply

- Insurance & legal costs per actuals

- Equal monthly installments after grace period

You Can Also Read: BISP 8171 Web Portal Update 2025 New Features, Payment Tracking and CNIC Verification Guide

Benefits of CM Punjab Asaan Karobar Finance for Young Entrepreneurs

The scheme helps young and aspiring entrepreneurs start or grow businesses without worrying about interest or high collateral. It promotes inclusivity and economic empowerment.

Advantages:

- Interest-free loan support

- Funding for startups & expansion

- Support for green & technology businesses

- Optional grace period on repayment

- Inclusive for women & differently-abled

- Boosts job creation in Punjab

- Transparent & digital application process

You Can Also Read: Massive Increase in Gold Price in Pakistan – The Biggest Increase in the Price of Gold in history

How to Track Your Application Status Online

Applicants can monitor their loan application digitally through the official CM Punjab portal. This provides real-time updates on approval, disbursement, and repayment schedules.

Tracking Steps:

- Visit official portal

- Enter application ID & CNIC

- Submit for status check

- View approval or pending status

- Check disbursement date

- See installment schedule

- Receive notifications via email/SMS

You Can Also Read: PM Laptop Scheme Started Again Get Loan for Laptop

Frequently Asked Questions

What is this program?

Interest-free loans for SMEs in Punjab to start or grow businesses.

Who can apply?

SMEs in Punjab, age 25–55, with valid CNIC & NTN and clean credit.

Loan amounts?

Tier 1: 1–5M PKR | Tier 2: 6–30M PKR, both interest-free.

Is it inclusive?

Yes, women, transgender, and differently-abled entrepreneurs are prioritized.

How to apply?

Apply online via the CM Punjab portal, upload documents, select loan tier.

Required documents?

CNIC & NTN, business proof, FBR registration, financial statements.

How to track application?

Use application ID & CNIC on the official portal for real-time updates.

You Can Also Read: BISP 8171 Card 2025 Launch Date, Registration, and Payment Details

Final Thought

CM Punjab Asaan Karobar Finance 2025 empowers youth and SMEs with interest-free loans, easy repayment, and digital transparency. It boosts startups, supports inclusive businesses, and promotes job creation across Punjab.

You Can Also Read: CM Punjab Ration Card 2025 Online Apply, Eligibility & Monthly Benefits