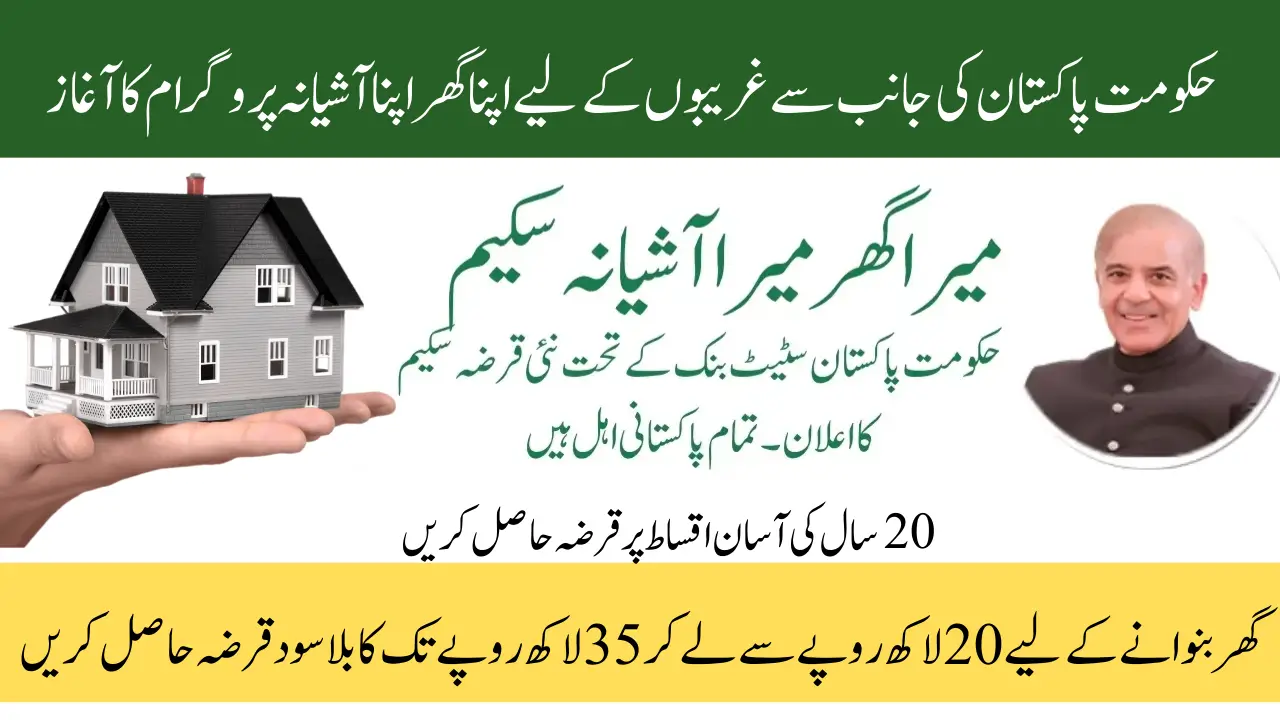

Mera Ghar Mera Ashiana Loan Scheme By SBP Online Registration

Mera Ghar Mera Ashiana Loan Scheme

State Bank of Pakistan (SBP) has launched a major housing initiative for low- and middle-income families under the Mera Ghar Mera Ashiana Loan Scheme 2026, aiming to make homeownership easier and more affordable than ever before. Through this program, individuals who previously could not afford to buy or build a house can now apply for a low-interest housing loan with flexible repayment plans and minimal documentation. The online registration process is open across Pakistan, allowing eligible applicants to apply conveniently from home.

This initiative is part of the government’s vision to provide affordable housing and financial inclusion under the Naya Pakistan Housing Program (NPHP). With the support of the State Bank of Pakistan (SBP) and commercial banks, thousands of families are expected to benefit from easy access to home financing. The scheme covers both the purchase of a new house or apartment and construction on owned land, giving beneficiaries the freedom to choose the option that best suits their needs.

Key Features of Mera Ghar Mera Ashiana Loan Scheme 2026

- Low-interest housing loans with long-term repayment periods of up to 20 years

- Flexible financing for construction, purchase, or renovation of a home

- Financing up to PKR 10 million, depending on income and property size

- Subsidized mark-up rates starting from 2% to 5%, supported by the SBP

- Equal monthly installments to make repayment easy and manageable

- Quick and simple online registration with minimal paperwork required

Eligibility Criteria for the Scheme

To apply for the Mera Ghar Mera Ashiana Scheme, applicants must meet the following basic requirements:

- Must be a Pakistani citizen aged 25 to 60 years

- Monthly household income should be within the low- or middle-income category (PKR 25,000 – PKR 150,000)

- Applicant or spouse must not already own a house in Pakistan

- Property must be located in an approved housing society or area

- Must provide valid CNIC, income proof, and bank account details

This program is specially designed for first-time homeowners and salaried individuals or self-employed workers who are struggling with high rent or lack of permanent housing.

Documents Required for Online Registration

To complete your online application, prepare the following documents:

- Copy of Computerized National Identity Card (CNIC)

- Latest salary slip or proof of business income

- Bank statement (last 6 months)

- Property documents or plot ownership papers

- Two passport-size photographs

- Utility bill for current residential address verification

How to Apply for Mera Ghar Mera Ashiana Loan Online

The registration process is simple and can be completed online in just a few steps:

- Visit the official website of the State Bank of Pakistan or your preferred commercial bank.

- Go to the “Mera Ghar Mera Ashiana Loan” section and click on Apply Online.

- Fill out the application form with personal, financial, and property details.

- Upload the required documents in the specified format.

- Submit the application and wait for verification and approval from the bank.

- Once approved, the bank will contact you to discuss loan disbursement and repayment plan.

Benefits of Joining This Housing Scheme

The Mera Ghar Mera Ashiana Housing Loan offers numerous advantages for Pakistani citizens:

- Helps families escape the rental cycle and own their first home

- Enables secure and stable housing with long-term financial planning

- Boosts economic empowerment by increasing property ownership among low-income groups

- Backed by State Bank of Pakistan, ensuring transparency and affordability

- Part of the government’s broader Naya Pakistan Housing initiative for inclusive development

Final Words

Mera Ghar Mera Ashiana Loan Scheme 2026 is more than just a loan program it’s a pathway to a secure future. With easy online registration, subsidized mark-up rates, and flexible repayment options, thousands of families now have a real chance to own their dream home. If you meet the eligibility criteria, don’t miss this opportunity complete your online registration today and take the first step toward owning a house in Pakistan.

FAQs

Q: What is the Mera Ghar Mera Ashiana Loan Scheme 2026?

A: A State Bank of Pakistan-backed housing loan program offering low-interest financing and long-term repayment to help low- and middle-income families buy, build, or renovate homes.

Keyword: Mera Ghar Mera Ashiana Loan Scheme 2026

Q: Who is eligible for the scheme?

A: Pakistani citizens aged 25–60 with household income roughly PKR 25,000–150,000, who don’t already own a home and have property in an approved area.

Keyword: Mera Ghar Mera Ashiana eligibility

Q: How much can I borrow?

A: Financing is available up to PKR 10 million, subject to income, property size, and bank assessment.

Keyword: Mera Ghar Mera Ashiana loan amount

Q: Can I use the loan to build on my own land?

A: Yes — the scheme covers construction on owned land as well as purchase of new homes or apartments.

Keyword: build on owned land Mera Ghar Mera Ashiana

Q: What are the mark-up rates and repayment terms?

A: Subsidized mark-up rates start around 2%–5%, with repayment plans up to 20 years and equal monthly installments.

Keyword: Mera Ghar Mera Ashiana mark-up rate

Q: How do I apply online?

A: Visit the SBP website or your preferred commercial bank’s “Mera Ghar Mera Ashiana” page, fill the online form, upload documents, and submit for verification.

Keyword: Mera Ghar Mera Ashiana online registration

Q: Which documents are required for application?

A: CNIC copy, last salary slip or business income proof, six months bank statements, property/plot papers, two passport photos, and a utility bill.

Keyword: Mera Ghar Mera Ashiana documents

Q: Can self-employed people apply?

A: Yes — both salaried and self-employed applicants who meet income and documentation requirements can apply.

Keyword: self employed Mera Ghar Mera Ashiana

Q: Will the bank contact me after I submit my application?

A: Yes — after verification the bank will reach out to discuss approval, disbursement, and the repayment schedule.

Keyword: Mera Ghar Mera Ashiana bank verification

Q: Is this scheme part of the Naya Pakistan Housing Program?

A: Yes — it’s a component of the government’s Naya Pakistan Housing initiative supported by SBP and commercial banks.